The Malaysian card payments market is expected to grow by 10.2% to reach MYR387 billion ($84.9 billion) in 2024, supported by constant consumer shift towards non-cash payments, says GlobalData.

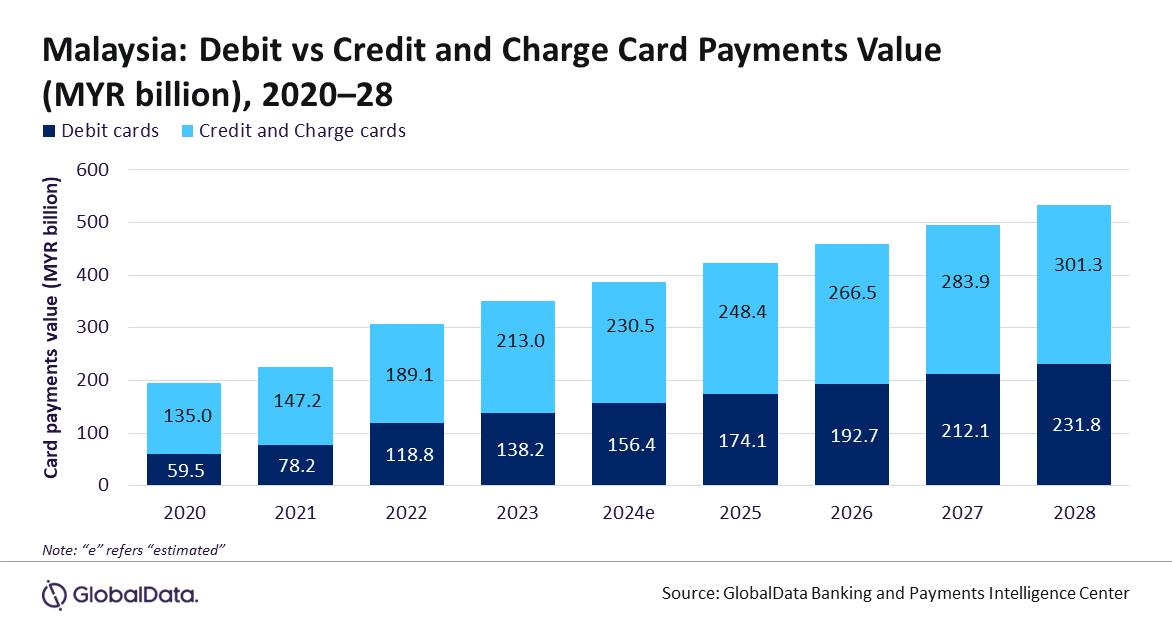

GlobalData’s Payment Cards Analytics reveals that card payments value in Malaysia registered a healthy compound annual growth rate (CAGR) of 14.3% between 2019 and 2023 to reach MYR351.2 billion ($77.0 billion) in 2023.

Poornima Chinta, Senior Banking and Payments Analyst at GlobalData, comments: “Malaysia is gradually moving towards the digitalization of payment infrastructure, supported by a growing banked population and a developing POS infrastructure. Although cash remains prevalent in Malaysia, it is gradually losing ground to electronic payments. Consumers are increasingly turning to payment cards, a trend that has accelerated in the wake of the COVID-19 pandemic.”

The growth has also been supported by improvements in POS infrastructure and government initiatives to push cashless payments. In 2022, Malaysia launched a campaign promoting cashless payment alternatives for all governmental transactions. Under this program, government agencies are equipped with adequate payment infrastructure, enabling consumers to utilize various digital payment methods, including debit/credit cards, digital wallets, and internet banking, to settle payments for services like utility bills, fees, and taxes.

In addition, the central bank is reducing the interchange fees to encourage merchants to accept card payments. Effective 1 January 2023, the central bank capped interchange fees for domestic and international debit cards at 0.10% and 0.27%, respectively, and at 0.6% for credit cards.

Contactless payments are also gaining traction in Malaysia, further contributing to the increase in the number of payment cards. According to the Bank Negara Malaysia, 68.9% of card transactions at physical premises were contactless in 2022, up from 64.6% in 2021.

Among the card types, credit and charge cards accounted for 60.7% share of the overall card payment value in 2023. This is mainly due to the value-added benefits associated with these cards such as flexible payment options and reward programs.

Debit cards, on the other hand, account for remaining 39.3% share. Although debit cards are traditionally preferred for cash withdrawals, they are now increasingly being used for payments as well – especially low-to-medium value transactions. This has been driven by the rising consumer awareness, banks offering contactless debit cards, and the expansion of the country’s POS network.

Chinta concludes: “Malaysia’s payment card market is expected to continue its upward growth trajectory, supported by the government initiatives, rising consumer preference for digital payments and growing adoption of contactless payments. While the economic slowdown presented some hurdles, the market is expected to bounce back and is anticipated to grow at a CAGR of 8.3% between 2024 and 2028 to reach MYR533.2 billion ($116.9 billion) in 2028.”