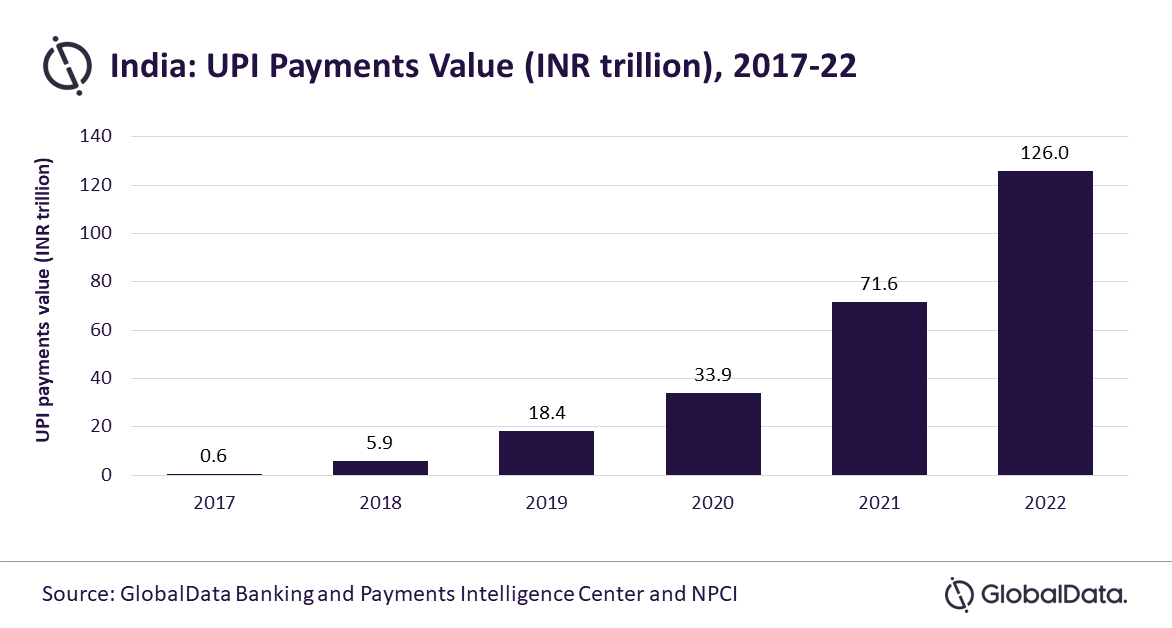

India has registered a significant acceleration in the digital payments space in the last few years, with Unified Payments Interface (UPI), the country’s instant payment scheme, alone registering a 75.9% growth in 2022 to reach INR126 trillion ($1.5 trillion).

Against this backdrop, UPI’s integration with Singapore’s instant payment scheme – PayNow will further expand its usage for international fund transfers and help position itself as a global payment brand, reveals GlobalData.

With the launch of the Immediate Payment Service (IMPS) in 2010 followed by the UPI in 2016, India has a well-developed instant payment infrastructure. While the former is primarily used for fund transfers, the latter is mostly preferred for day-to-day payments in addition to regular fund transfers.

UPI payments value in India rose from INR570.2 billion (US$6.9 billion) in 2017 to INR126 trillion (US$1.5 trillion) in 2022, registering an exponential compound annual growth rate (CAGR) of 194.3%, according to GlobalData.

INR570.2 billion (US$6.9 billion) in 2017 to INR126 trillion (US$1.5 trillion) in 2022, registering an exponential compound annual growth rate (CAGR) of 194.3%, according to GlobalData.

Ravi Sharma, Lead Banking and Payments Analyst at GlobalData, comments: “UPI has revolutionized the entire consumer payment space in India within just few years of its launch and now become a mainstream payment method and is widely used for day-to-day payments. It has emerged as an alternative to cash and other traditional payment tools such as cards and bank transfers.”

Launched by the National Payments Corporation of India (NPCI), UPI allows customers to integrate bank account with mobile payment solution and enables instant transfers between bank accounts from mobile phone using virtual ID, mobile number or QR code, making transactions quicker. It is increasingly used for day-to-day transactions, a trend that gained further momentum during the COVID-19 pandemic as consumers preferred to use non-cash payment methods.

Sharma adds: “Rising banked population, high smartphone penetration, and proliferation of UPI-enabled mobile payment brands are some factors driving the growth. The UPI-based payments space is mainly dominated by third-party payment solution providers like Paytm, Google Pay and PhonePe.”

To further expand its coverage, UPI has been officially integrated with Singapore’s instant payment scheme – PayNow on February 21, 2023. This will help users in the both countries to make low-cost cross-border fund transfers. Some of the banks that are part of this engagement include State Bank of India, Indian Overseas Bank, Indian Bank, ICICI Bank, and DBS, with others expected to join the list soon.

Sharma concludes: “The widespread QR code infrastructure in India coupled with rising mobile wallet adoption and high merchant acceptance led to significant rise in UPI based payments in the country. The collaboration with international counterparts like PayNow will further expand its presence beyond its national boundary and help position itself as a global payment brand.”